Investing

It’s easy to let ourselves believe that responsible investing – or any investing, for that matter – is for the wealthy. We may not know exactly how wealthy one has to be to start investing money effectively, but we’re pretty sure they must have more disposable income left over each month than we do. Sure, it would be nice to do more in terms of investing for retirement and we know a few guys at work who seem to be into online investment tools of some sort and get excited talking about investment strategies, but we figure they just like to talk big or something.

Maybe that’s true. Maybe it’s just like craft beer or working on vintage cars – some sort of specialized world that’s fine for those who are into it, but normal folks like us have little to gain from paying attention. Or maybe the 21st century really has opened up all sorts of investing options and investment strategies for pretty much any American at any income level who’s wiling to take a little time and explore a few ways to invest money for the future – theirs or those they love.

Spoiler alert: it’s that second one. So, why should you be thinking more seriously about investing? And what does that even look like for “normal” people?

When you save money at home, under the mattress or in a change jar, you’re conserving. You’re trying to hold on to wealth (big or small) and build it up over time by adding to it. You may lose a little value over time due to inflation, but it’s otherwise generally safe to keep your wealth locked up and hidden at home. Safe, but not profitable. You can accumulate this way, but the money doesn’t grow this way unless you’re actively adding to it.

If you put that money in a savings account at your local bank or credit union, you make a little interest on it over time. Why can the institution afford to pay you? Because they take that money, along with everyone else’s in their care, and invest it in various ways for their own profit. You’re essentially lending them money to use so they can generate wealth for themselves, and in return you get a small slice of the results. Your money won’t grow very fast this way, but it will grow. This is also a very low-risk way to save for retirement or whatever the future holds. Plus, your savings with any legitimate bank or credit union are automatically insured by the government up to $250,000 – so that’s kind of a big deal.

Investing is when you use a portion of your resources more actively. You take a little risk in hopes of making a small profit. Or, you take a bigger risk in hopes of a larger profit. You take responsibility for helping your resources grow so you’ll have more when you need it.

When you save money at home, under the mattress or in a change jar, you’re conserving. You’re trying to hold on to wealth (big or small) and build it up over time by adding to it. You may lose a little value over time due to inflation, but it’s otherwise generally safe to keep your wealth locked up and hidden at home. Safe, but not profitable. You can accumulate this way, but the money doesn’t grow this way unless you’re actively adding to it.

If you put that money in a savings account at your local bank or credit union, you make a little interest on it over time. Why can the institution afford to pay you? Because they take that money, along with everyone else’s in their care, and invest it in various ways for their own profit. You’re essentially lending them money to use so they can generate wealth for themselves, and in return you get a small slice of the results. Your money won’t grow very fast this way, but it will grow. This is also a very low-risk way to save for retirement or whatever the future holds. Plus, your savings with any legitimate bank or credit union are automatically insured by the government up to $250,000 – so that’s kind of a big deal.

Investing is when you use a portion of your resources more actively. You take a little risk in hopes of making a small profit. Or, you take a bigger risk in hopes of a larger profit. You take responsibility for helping your resources grow so you’ll have more when you need it.

We’ll help you compare investment apps (there are a number of good ones that aren’t that hard to use, and we have some exciting news in that area coming soon) to simplify your baby steps into investing. We’ll make sense of terms you never knew you didn’t know – from discussing the best approach to portfolio investment to the pros and cons of an equity fund to unraveling ETFs Bonds and Mutual Funds. Yes, the terminology gets a bit hairy sometimes. Sure, some of the concepts are a bit thick. But it’s not magical and there’s no reason it all has to be secret.

The basic concept of investing is simple. Investing is any use of money in support of a particular commercial venture or other profitable undertaking with the expectation of financial benefit. At its most basic, it’s lending Garry a few bucks so he can buy a comb and scissors and start cutting hair professionally. If Garry is successful and his barber shop makes a profit, you’ll get your money back, plus a percentage of those profits for helping him out. As you consider Garry’s potential, however, you notice in the local paper that Juanita – who runs your favorite lunch place – is looking to expand and needs extra cash to do so. Maybe your money would be better focused there instead. Should you roll the dice on Garry, Juanita, or split your support between both to hedge your bets?

However fancy the mechanisms or complicated the terminology, most investment options come down to trying to figure out if Garry or Juanita will make you the most money for what you’re willing to put in. That calculation is called your “return on investment” or ROI. Your profit (or loss) is the dollar amount difference between what you initially invested and what you get back. If you invest $3,000 in Juanita’s restaurant expansion and get back $4,000 within the same year, you’ve made a profit of $1,000. Your ROI (return on investment) is your profit (1000) divided by your investment (3000) = 33%. (It’s also possible to lose money on your investments, in which case your ROI is expressed as a negative number.)

Understanding ROI is useful if you’re trying to figure out which investments are most profitable even though the dollar amounts aren’t the same. Let’s assume you chose to invest $3,000 in Juanita last year and made the $1,000 gain from the example above. Your annoying co-worker brags that he invested $5,000 in Garry’s barbershop and made $1,500 during the same period. His dollar gain was a little higher than yours, and that matters. He did make more. However, he invested more in the first place. His ROI (return on investment) is his profit (1500) / his investment (5000) = 30%. Turns out you invested more effectively than he did; he simply started with more money so his results looked more impressive.

Many of the most popular and practical ways to invest money in the 21st century no longer look like a choice between Garry’s barbershop and Juanita’s restaurant. Modern investing often leaves investors so far removed from how the money’s actually being used that it’s easy to forget that’s the whole point in the first place. Without entrepreneurs or businesses looking to secure capital for growth or innovation, there’s no stock market and very limited opportunities to invest because there’d be no use for your money elsewhere.

Of course, in most cases you don’t have to worry about whether or not Garry or Juanita is at the other end of your investing choices.

In the 21st century, you can make educated decisions about the best investment plan for you without worrying about the details or the end results. Or, you can decide that the best investment plan for you is precisely about the details and end results. That’s the beauty of so much choice.

To make good choices, of course, you have to first have some idea of your options. Let’s look in general terms about some of the most common ways to invest money in the 21st century for people who aren’t particularly wealthy but are willing to take more effective control of their personal or small business finances and in so doing, take better control over their futures. First, however, let’s address a few fiscal elephants in the virtual room.

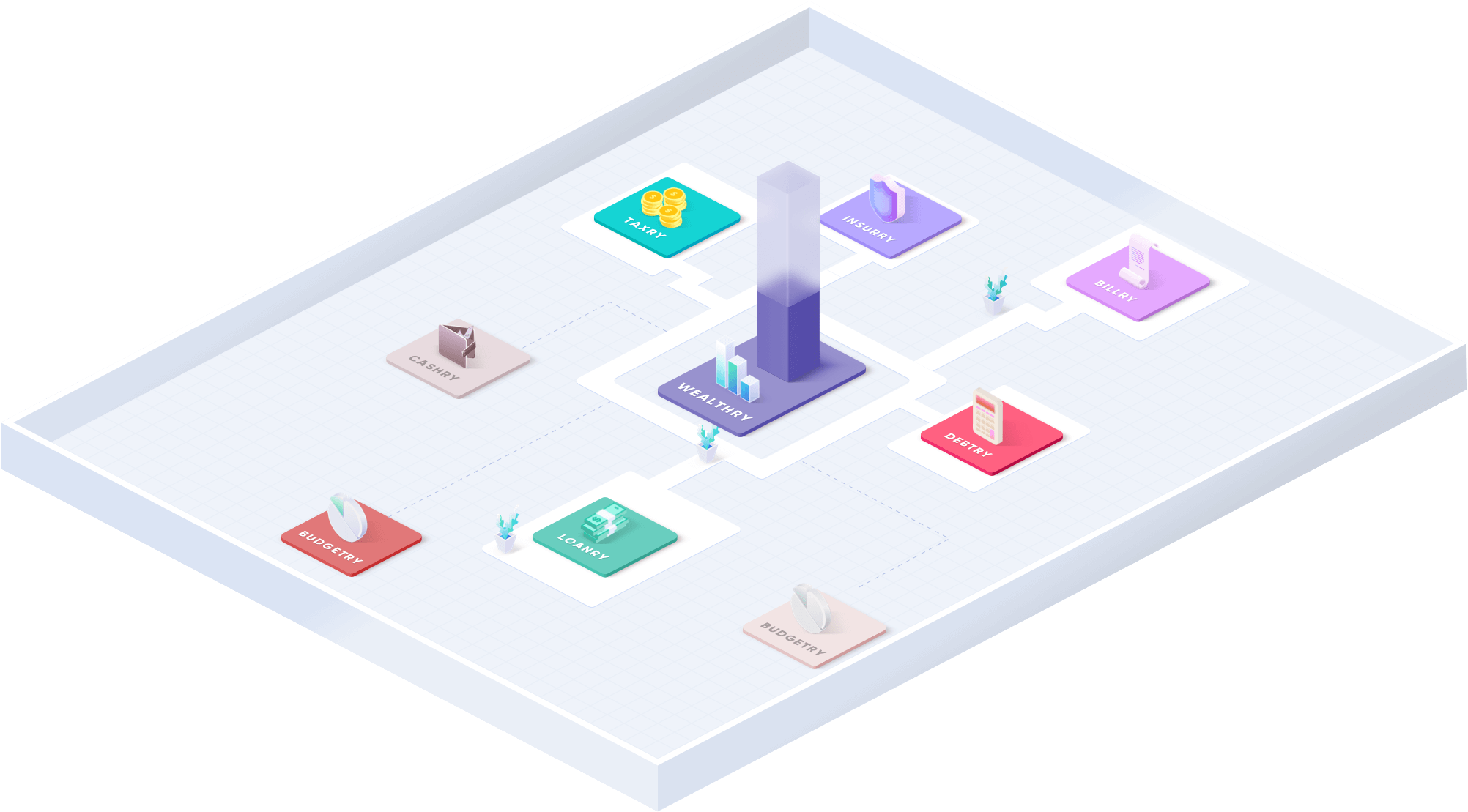

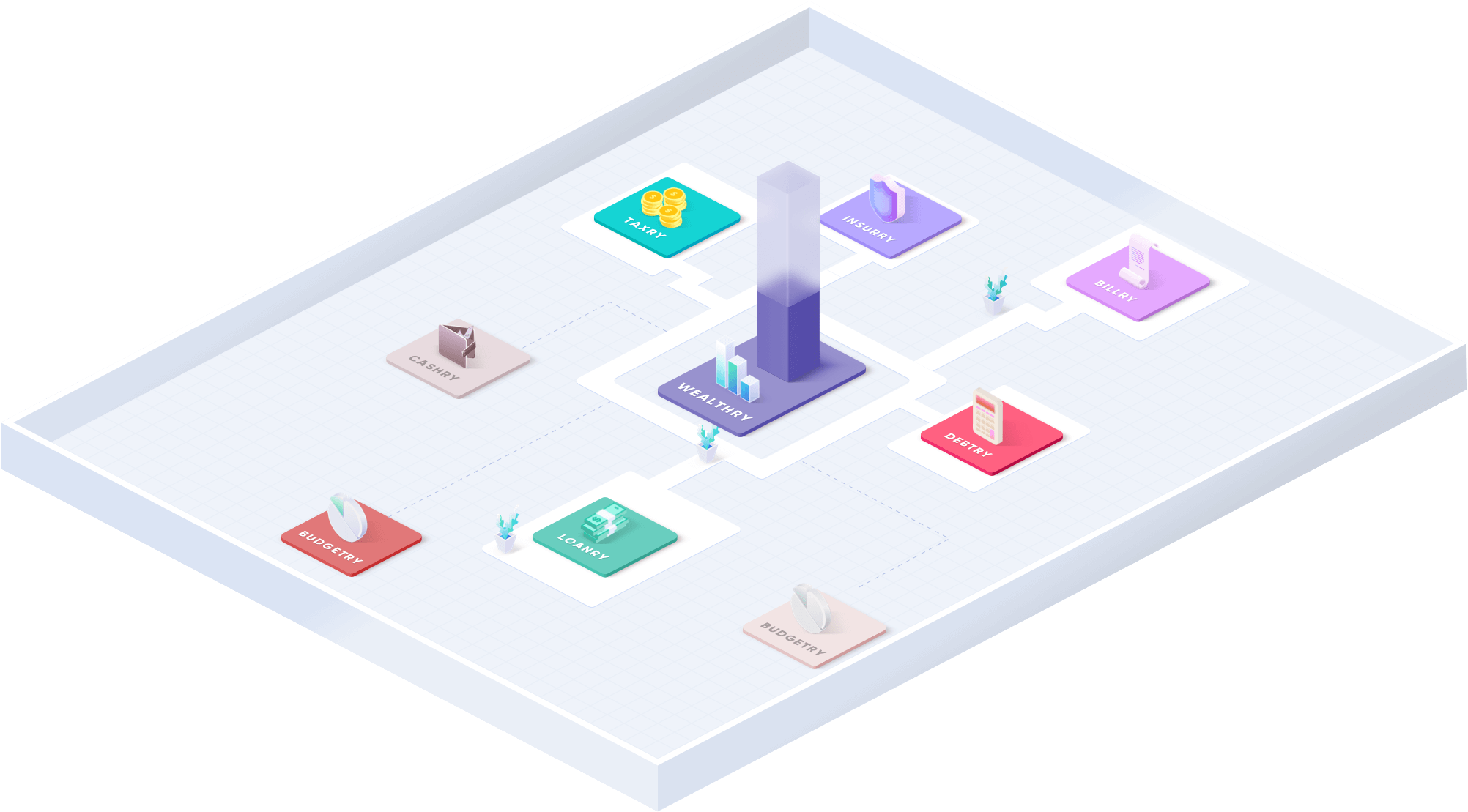

We’ve only scratched the surface of investing for yourself and your future, as well as the future of those in your care. Hopefully you’ve gained a general idea of some of the many options out there. Each one may simply bring up more questions. That’s a large part of why we created Wealthry as part of the Goalry family of unified finance.

We have an underlying conviction that most of us are perfectly capable of taking more effective control of our personal or small business finances if only provided with the right information, tools, connections, and opportunities. We don’t believe that it makes sense to treat your personal savings as if it’s completely unrelated to your investment for retirement, or treat your credit card debt as if it has nothing to do with making your mortgage payments or making decisions about budgeting or lowering your rent. Money isn’t everything, but it impacts almost everything in our worlds for better or worse. Understanding and using it better can only give us more options and opportunities.

You don’t have to everything in your financial world perfect before you can meaningfully begin investing money towards the future. However, if you don’t have an effective household budget, this is a great time to start one. You can’t effectively plan for the future if you don’t accurately know what’s happening in the present. Creating and sticking to a household budget isn’t about anyone else telling you want to do with your own money. It’s about knowing more accurately and usefully what you’re choosing to do with your own money, and giving you more control over those decisions.

You don’t have to have zero debt for investing to make sense. However, if you’re in serious debt trouble, it might make sense to first focus on paying down that debt. Debt sucks away resources – the additional fees and interest you pay and the damage it does to your credit and financial flexibility can easily offset the gains you’re making from investing.

Finally, you may be wondering about the best time to start investing. Maybe it seems like you’ve got plenty of years ahead of you and there’s no hurry. Or, it seems like that ship has sailed and there’s no point starting now. But the best time to start investing is easy. It’s now. If you’re not investing, now’s the best time to start. Whether you’re 18 or 50 or 71, you and those you love can benefit from your strategic investments.

A 401(k) is a retirement plan chosen by an employer to offer their employees. Some pay into 401(k) plans as part of your benefits package, but it’s not required. You generally have input over how much you’d like to have deducted from your check each month to go towards your 401(k). The amount you choose is pre-tax, meaning when you contribute to a 401(k), you’re lowering your taxable income. While it’s not technically a tax free savings account, it certainly acts as one for a long period. You’re also usually given the option of choosing a general investment approach - high risk (with potentially higher returns), medium risk (with more moderate returns), or low risk (more reliable but lower returns).

The 403(b) is a very similar program for employees of public schools or other tax-exempt organizations – teachers, government employees, nurses, librarians, preachers, etc.

IRA stands for “Individual Retirement Account.” As the name suggests, it’s something you initiate rather than something your employer offers. You can set up a Traditional IRA through your local credit union or many reputable online financial institutions and determine the size of your contributions each pay period. In many cases, the money you contribute can be deducted on your tax return, and your earnings are not taxed until you withdraw them after you retire. Like a 401(k), it acts as a sort of tax free savings account until you actually use the funds.

A Roth IRA flips that – you pay taxes on your income, including what goes into your Roth IRA, but the funds aren’t taxed when you withdraw. A Rollover IRA allows you to “roll over” funds from another retirement plan, like a 401(k). This makes sense if the tax conditions or interest rates that come with your IRA are better than those associated with your other retirement plan. You might also have more control over how the funds are invested, if you like the “hands-on” approach. In other words, this one’s all about the details.

The Stock Market is a perfectly simple idea with a very complex reality. There’s no shame in keeping things simple if you choose to make stocks one of your investment options. Essentially, you purchase “shares” in companies which you believe will increase in value, then sell them when you think they’ve hit their highest price. This description, however, is like saying that to play the piano you simply hit the keys that correspond to the notes on the page for the right length each time. It’s technically accurate, but falls short of capturing the actual process.

Buying and selling have their own dynamics and strategies, and there are often a half-dozen types of shares to sort out before you even get that far. That doesn’t mean you can’t do it, but the intelligent investor starts by being honest with themselves about their own strengths and weaknesses.

Most people need a broker to buy and sell stocks. You set up a brokerage account and agree to established fees per transaction and other terms spelled out in advance. Old school full-service brokers are still very much a thing, but they deal primarily in large accounts and take a substantial cut of out each transaction. The past few decades, however, have seen the rise of discount brokers – often online. They’re not going to spend hours with you talking through your financial philosophies or discussing the best investment plan for your circumstances, but they will help you set up a brokerage account and buy and sell for you. Online investment is becoming the norm rather than the exception; there’s no reason brokers shouldn’t follow suit. The better ones offer extensive educational materials on their sites and automated “robo-advisors.” (These are not to be confused with robo investing, which is also largely automated and low-cost to you.)

Robo-advisors are essentially sophisticated algorithms which gather your basic information then offer advice on investment strategies and answer common questions about the market. While you’re still in control of the major decisions, keep in mind that playing the stock market is largely about data juggling and reacting to changes in complex combinations of numbers – things computers are quite good at. They may not be ideal for setting you up on a blind date or diagnosing that weird rash, but their track record with investment advice is impressive – and at a much lower cost than a traditional broker.

The Wealthry blogs are a great place to start for more specific information on investing in the stock market. We can point you to other reputable sites as well. Remember that as important as the stock market is to many investors, it’s still only one option among many in terms of your personal investing options.

The intelligent investor almost always devotes at least part of their resources towards mutual funds. These are financial instruments which combine a variety of stocks and other investment options into a single package – like a variety pack at the fireworks stand or a shrink-wrapped snack tray at the grocery store. Investors are combined as well, so that you potentially have hundreds of investors each owning very small slices of dozens of stocks – a bundle investing in a bundle, as it were.

This diversity increases security. Maybe not all the fireworks will go off, but most will. Maybe not everyone will love the green cheese, but most will find something they enjoy. Maybe some parts of the mutual fund won’t perform, but most will (hopefully). The best mutual funds aren’t about dramatic returns; they’re about consistency and reliability. They’re also one of the easier types of investments to get started with since they don’t require a huge investment to begin.

When you purchase bonds, you’re essentially loaning a financial institution (or the government) a set amount of money for an extended time period. When the bonds mature, you receive your investment back with interest. If you’ve ever given or received “savings bonds” or “treasury bonds,” you’re familiar with the system. These are one of the safest ways to invest, although returns are fairly modest. It’s also difficult to cash in bonds ahead of the scheduled dates without substantial penalties – which can be both a pro and a con.

CDs are “Certificates of Deposit.” You agree to leave a certain amount of money in one of these accounts for a specific amount of time – usually one to five years. The longer you agree to leave your money in the account, the better interest rate you’ll be offered. CDs are insured by the FDIC and one of the safest ways to invest. Like bonds, the interest rates are higher than a simple savings account or even many other investment options. Also like bonds, you’re committed for a pre-set time period unless you want to pay penalties.

Real estate has several potential advantages over most other options. It almost never loses value over the long term. It’s tangible – you usually know where it is and what it looks like. It’s useful – everyone needs land and property at some point. There are several ways you can make real estate investments.

The most straightforward is to buy land, with or with improvements on it, and attempt to sell it at a profit at a later date. You’re no doubt familiar with all the “flipping” shows popular on television, and while they’re rarely realistic about the time and costs involved, the basic idea is one many people have applied successfully and done quite well for themselves. Sometimes it’s not even about improving the property so much as buying right – anticipating future demand.

You may choose to buy property to rent out residentially or commercially. This obviously comes with its own headaches, but again – many people have managed to do this successfully. If you have the personality and skill set for it, it’s worth considering. You can access these through the same sorts of online brokers that handle stock market transactions for you.

There are less traditional real estate investments out there, however. A Real Estate Investment Trust (REIT) allows you to invest in real estate in the same way some invest in mutual funds. The REIT does not represent a single specific property so much as a combination of different sorts of properties in different places and price ranges. This means the REIT is by its nature quite diversified – a downturn in housing in one region may be offset by increased commercial building in another.

The award from most confusing use of terminology has to go to whoever first coined the phrase “money market.” It can mean several different things depending on context.

A money market account (MMA) through your local bank or credit union is a love child of a traditional savings account that clearly has your checking account’s eyes. You make deposits like it’s a savings account, but you can make a limited number of checking account-like withdrawals without penalties. Money market accounts are insured by the FDIC like a regular savings account.

Money market funds (MMF), on the other hand, are a type of mutual fund that focus only on “high liquidity instruments” – fancy financial-speak for “short term loans.” The specifics get rather complicated, and while the intelligent investor usually wants to know precisely what he or she is investing in, there are times it’s best not to watch the sausage being made too closely. It’s easiest to think of money market mutual funds as a constant shuffling of cash, certificates, and other “papers” back and forth between banks, the government, and other institutions – often every day and never for longer than a year at a time. That means tiny gains (or losses) multiplied by multiple transactions – another option for fairly safe investment, but only intended as a short-term place to park investments. The best money market rates are still fairly low; like with other mutual funds, the priority is relative security.