Banking

It’s funny what things are and aren’t covered in school or considered essential by parents. Math? That’s school. Cooking? Mostly home. Driving? That can go either way, or both. “The Talk?” Well, that one kinda depends on what sort of community you live in. Either the schools had better cover it, or they’d better not! Sometimes both. Makes you glad you’re not on the board. Far too often, it seems, banking and checking and debit cards and savings accounts simply don’t come up when we’re young.

Then, we’re suddenly adults and they’re one of those things we’re expected to somehow know, even though no one’s actually ever explained them to us. It’s as if everyone else has a gene for “high yield savings accounts” or picked up a desire to compare money market accounts from cartoons or those vampire books they loved as a teenager.

Or maybe competitive cd rates and mortgage refinancing terminology is covered in the same secret guide everyone else seems to use to recognize rare dog breeds and cite lyrics to Beatles songs you’ve never even heard.

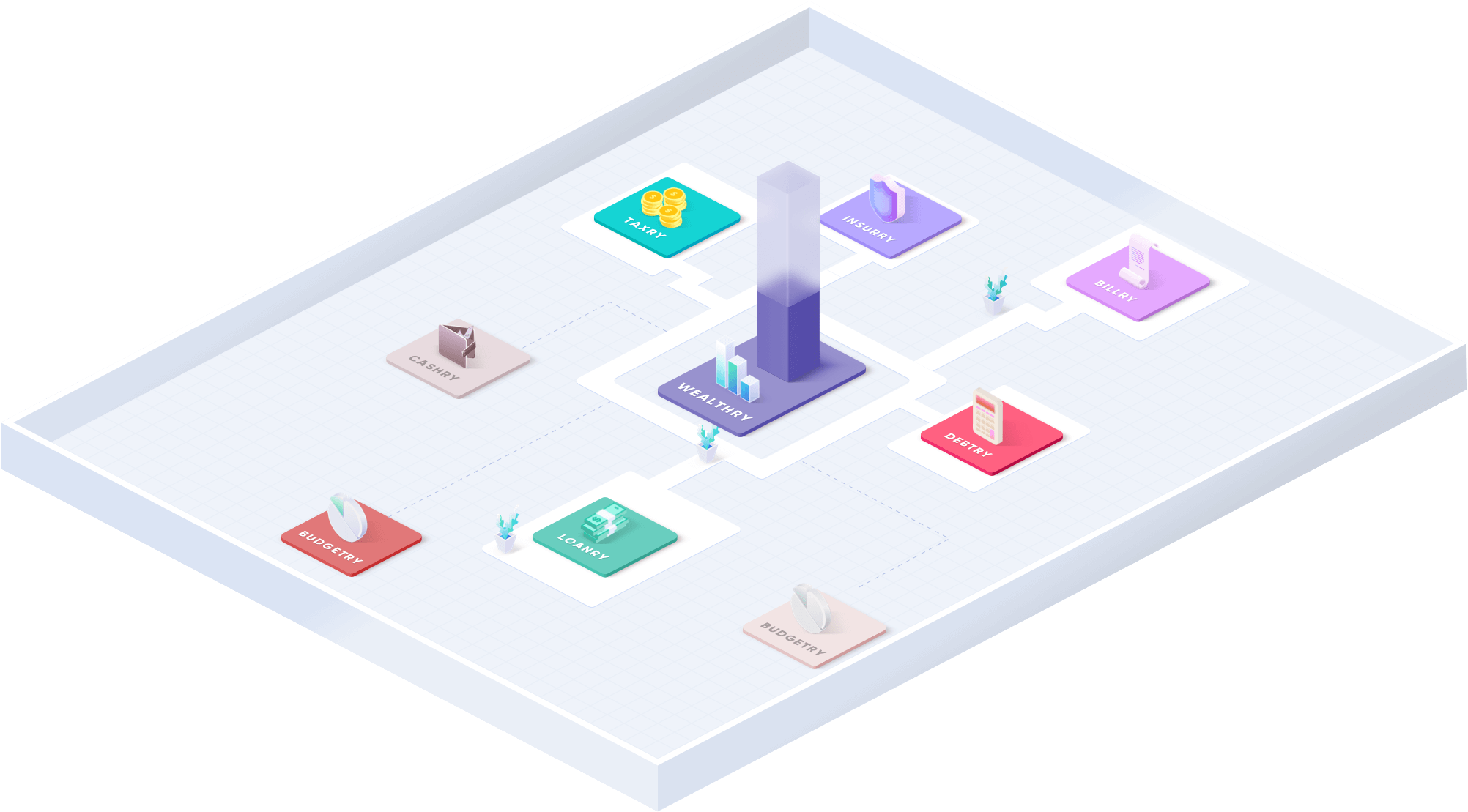

For those of us who were either not born with the banking terminology gene or who apparently read the wrong vampire books, here’s a general overview of the world of personal and small business financial institutions and services. If there’s something you discover you’d like to know a bit more about, check out the Wealthry blogs. Chances are good we’ve covered it in more specific detail, and if not, drop us a line and we’ll see what we can do.

The first thing you have to decide about your banking is whether or not you want to use a bank. That may sound a bit strange at first, but the fact is that the best bank accounts aren’t always from banks. There are three general categories of financial institution with which you’re likely to do your personal “banking” – banks, credit unions, and online banks (which are different than the presence most traditional banks have online).

Confused? Don’t worry. It’s not as complicated as it sounds.

We have an underlying conviction here at Wealthry, and across the Goalry family, that most people are perfectly capable of taking more effective control of their personal and small business finances if provided with the right information, tools, connections, and opportunities.

The two most basic accounts you’re likely to open with a traditional bank, credit union, or direct (online) bank are a checking account and a savings account. Most people have both, but it’s not always required. Some of the difference are obvious, while others may catch you off guard. As always, read the paperwork from any institution for any sort of account before you sign.

In the beginning, there were banks.

OK, not quite all the way back to the beginning, but not far from it. Banks have existed in some form since around 2000 BCE, before Ancient Greece or the Roman Empire. Banking as we now understand it has its roots in the Renaissance – specifically 14th century Italy and some of the wealthy families you probably encountered in high school or college at some point. The money they made in banking largely paid for those famous works of art we recognize and feel like we’re supposed to know more about. (They’re in the same secret guide as the dog breeds and Beatles lyrics.)

Banks today have evolved considerably, and no two are exactly alike. In general, however, a bank is a for-profit business whose goal is to make money like any other business. It does this by offering a range of financial services to individuals and other businesses.

Banks have several potential advantages over other options. Well known popular bank chains have more locations and ATMs, making them more convenient and accessible when you’re not close to home. They tend to offer the widest selection of financial services and support. On the other hand, their fees tend to be higher and the interest rates they pay customers lower. Banks are by their nature conservative institutions and not known for their flexibility with poor credit or challenging circumstances. Keep in mind these are generalizations; there are plenty of exceptions if you look hard enough. Many top banks have responded to the increased competition in recent decades with promotional offers or creative perks.

Credit unions are relative newcomers to the scene. The earliest variations appeared in Japan and Germany in the 19th century and they came to the U.S. less than a century ago. A credit union is a not-for profit organization which otherwise operates very much like a bank. Generally, credit unions serve a specific population – employees of the same company or profession, community members from the same region, current or former members of the military, etc. In practice, however, it’s often just as easy to become a member of a credit union as it is to walk into a commercial bank as a customer.

Because they’re not built as profit-making machines, credit unions tend to have fewer fees and pay better savings account interest rates. Credit unions are often more focused on customer service, having been developed primarily as a service for a specific group to begin with, and are generally more flexible with individual circumstances when it comes to lending or other transactions. On the other hand, many are smaller operations and may not be accessible when you’re not close to home. Options may be more limited, and many don’t offer the range of investment or savings options that banks can.

In the past few decades, online financial institutions have become a viable – and in many cases, preferable – third option. These are not to be confused with the many online services most brick-and-mortar banks and credit unions are offering. Completely “virtual” banks, often called “direct banks,” offer most of the same services as more traditional institutions but without physical locations for customers to visit.

Online institutions don’t have the overhead their brick-and-mortar counterparts do, and very few do much in the way of advertising or traditional promotions. This allows them to offer extremely competitive terms for many common banking needs. Very often the lowest fees, the best savings account rates, and the most flexible terms come from online lenders. On the other hand, some find it disconcerting to place so much trust in an unknown entity – especially when they can’t actually sit down with them face-to-face. Some online institutions specialize in specific types of financial services rather than offering a full range of options. This allows them to excel in those services but can make it more difficult to find the right fit for yourself.

The volume of online lenders and banking services has opened the door for marketplaces like Loanry (a part of the Goalry family) to act as curator and connect customers with the most promising options for their specific needs. Clients get the best of both worlds – the personal attention you’d want from a physical location but the advantages of online lenders or financial services. More and more people are recognizing the benefits of online lenders, who can often offer them far better options than a traditional bank loan could. Many don’t realize, however, that many offer more day-to-day services as well, from debit cards to high interest savings.

We may be a bit biased, but that doesn’t mean we’re wrong. The feedback we receive suggests virtual banking is not only a viable option, but an increasingly successful one. You might want to keep your eyes on this site for some exciting new options when it comes to virtually connecting to the ideal direct banking services for your specific circumstances and goals, just as easily as you clear the bars on your fitness tracker or pull up that funny video you wanted to show your co-worker.

Before you decide where to do your financial business, take a moment to compare the services you’re most likely to use. If you know that you only need some basic checking and maybe a small savings account, your primary concern is probably convenience and making sure there are no hidden fees or penalties for not being a big-money account. If you’re considering a business bank account along with your personal banking, on the other hand, you’ll want to specifically explore the services and benefits related to small businesses. Small business banking can open up a whole range of different needs and priorities. You probably want to have a face-to-face talk with a representative before committing to a business bank account to get a feel for the people as much as the services.

It’s easy enough to compare a specific institutions money market rates with national averages, but that only makes sense if you’re likely to invest in a money market savings account. It’s also not the only consideration. You can compare money market accounts all day long, but if you realize after setting everything up that CDs are a better way to go, the results may not be the same. Take a moment and assess your most likely needs, and focus on those when making your decision.

These aren’t things to stress about excessively. This isn’t your parents’ financial world and you have far more flexibility and options than you would have even a few decades ago. Depending on your lifestyle, it may come down to bank interest rates or who offers the top savings accounts, or it may make more sense to focus on convenient online access and who has the most no-fees ATMs in your area. Of course, if the institution you’re considering doesn’t have full online banking options and remote deposit, along with real time virtual assistance, it’s worth asking what century the rest of their services are in as well. The important thing is to think through the different factors and get a general picture of your options before you commit.

As you consider your various options – traditional banks, credit unions, and direct (virtual) banks, you’ll quickly discover that many institutions offer a wide range of other services as well. These might include…

Safe Deposit Boxes – These offer secure storage for valuables or important paperwork, accessible only to you.

Credit Cards – Most banks, credit unions offer their own credit card options, and the online selections are nearly limitless.

Loans – These can be everything from small personal loans to pay off medical debt to larger loans to finance a vehicle or consolidate debt. While many institutions offer these, it’s no longer assumed that you’ll seek your mortgage or home equity loan from a particular bank or credit union just because that’s where you do your checking. Should you check them out when it’s time? Absolutely. Is it a given they’ll offer the best terms for you and your specific circumstances? Not even close.

Those sweet savings account rates or CD rates you’re getting have nothing to do with the terms you can secure for refinancing your home. There’s nothing wrong with having a debit card from a popular bank in your area, but the best options for any loan aren’t automatically found at the top banks. If anything, they have less motivation to be flexible and win your business. They’re already one of the top banks – why should they take a chance on you?

Your checking account is a workhorse account generally used for depositing your paycheck, buying groceries, paying bills, and otherwise taking care of life’s ongoing expenses. They’re named for the paper checks which traditionally accompany them, although more and more people are using debit cards. Debit cards LOOK like credit cards but WORK like checks. They do not provide you a line of credit the way their counterparts do, but instead pull money directly out of your checking account to pay for purchases.

Debit cards are generally quicker and easier to use than writing checks, and give you much of the flexibility of credit cards without the debt. On the other hand, you can only spend what you actually have, so it’s essential that you keep track of your balance with every transaction. Most banks still offer paper checks, and they can be convenient for some transactions – particularly when taking care of things through the mail. Checks are increasingly unnecessary however, and you usually have to pay for the physical checks if not the service itself.

You should be able to find a checking account with little or no fees, although it’s equally unlikely to pay interest on the money you store there. Checking accounts make money for banks in three basic ways. First, they invest money customers deposit to invest on their own behalf (which is why they can afford to let you have the account for free). Second, they use it to draw in customers who may later apply for a home loan or set up a retirement account or some other pursuit profitable to the bank. Third – and this is a biggie – they charge fees for things like overdrawing your account or letting your balance fall below a specified amount.

No one plans on spending money they don’t have in their account. Banks know better, however. This is one of their biggest money-makers, and there’s nothing illicit or illegal about it. It’s entirely up to you whether you end up paying hundreds of dollars a year for not paying attention to your balance.

Savings accounts are exactly what their name suggests – a place to save money. They may pay a little interest, but these days it’s rarely enough to get excited about. You can often draw from your savings using the same debit card tied to your checking account, and most banks let you easily transfer money from one account to the other. There are sometimes fees for excessive transactions from your savings or letting your balance fall below a specified limit. Generally, however, the line between checking and savings has increasingly blurred as financial institutions compete for customers, each trying to offer more flexibility and convenience than the next.

The best savings account might not be a savings account at all. Most financial institutions offer Certificates of Deposit – CDs for short. These are essentially savings mechanisms in which you promise to leave a certain amount of money in savings for a set amount of time. They can be as short as six months or as long as ten years or more, but one to five years are typical. Because the institution can rely on that money staying put for a while, you can earn much better interest rates at almost no risk. Of course, if for some reason you decide to withdraw that money before the agreed-upon date, expect a hefty penalty.

Another option is a Money Market Account (MMA). These are not to be confused with a Money Market Mutual Fund (MMF). The MMF is an investment option with all the risks that come with that sort of thing. An MMA, on the other hand, is another form of savings account which allows limited transactions of the sort you have with a checking account, but still pays a higher interest rate than traditional savings accounts. They’re insured by the FDIC just like any other savings account, and can be an excellent compromise between basic savings and CDs.

In the 21st century there’s no reason to do any of your business with anyone who doesn’t feel the same way. We believe in transparency and making it easy to connect to the services you need, and our explosive growth suggests we’re on the right track.